The Ultimate Guide to Software Development Life Cycle

Discover what is software development life cycle. Learn stages, importance, and models with our ultimate guide. Optimize your software projects now!

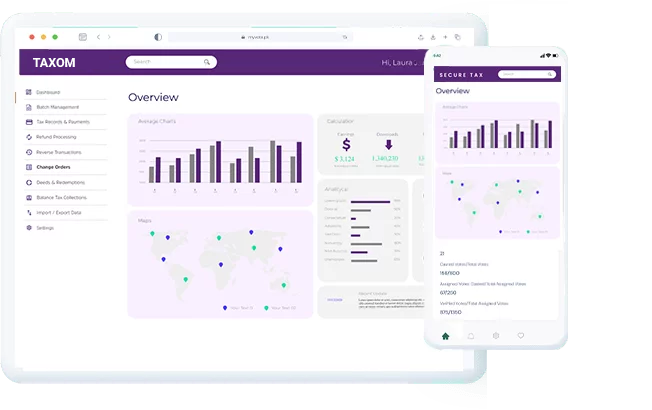

See how we’ve helped Tax Office in Collecting and Distributing the Tax amount effectively !

Our client, a property tax collection office for a US state, utilizes a robust tax office management system to ensure the efficient collection, management, and distribution of property tax across eight parishes. This system empowers residents to submit their property tax payments through a secure web application, while simultaneously streamlining tax office personnel’s workflows for managing collection and distribution activities within a single, centralized platform.

Finance, Tax Management, B2G

2020 – Present

Python, React, AWS, Paystar, NMI

End-to-End Product Development

Property tax collection is a complicated system in the US. This is because tax laws differ not only between states but even among local jurisdictions within the same state. These inconsistencies and many other variables make it hard for taxpayers and state tax offices to employ consistent and scalable processes, particularly during peak tax season. Our client faced similar challenges during tax collection for multiple parishes in their state. The existing system used outdated techniques, including manually inputting information into Microsoft Excel and other obsolete management systems. Furthermore, it was not user-friendly, offered a poor user experience, and was packed with security concerns. The client demanded a modern, secure, efficient, and user-friendly management system for property taxes to facilitate the customers (taxpayers) so they would be able to pay taxes from the convenience of their homes.

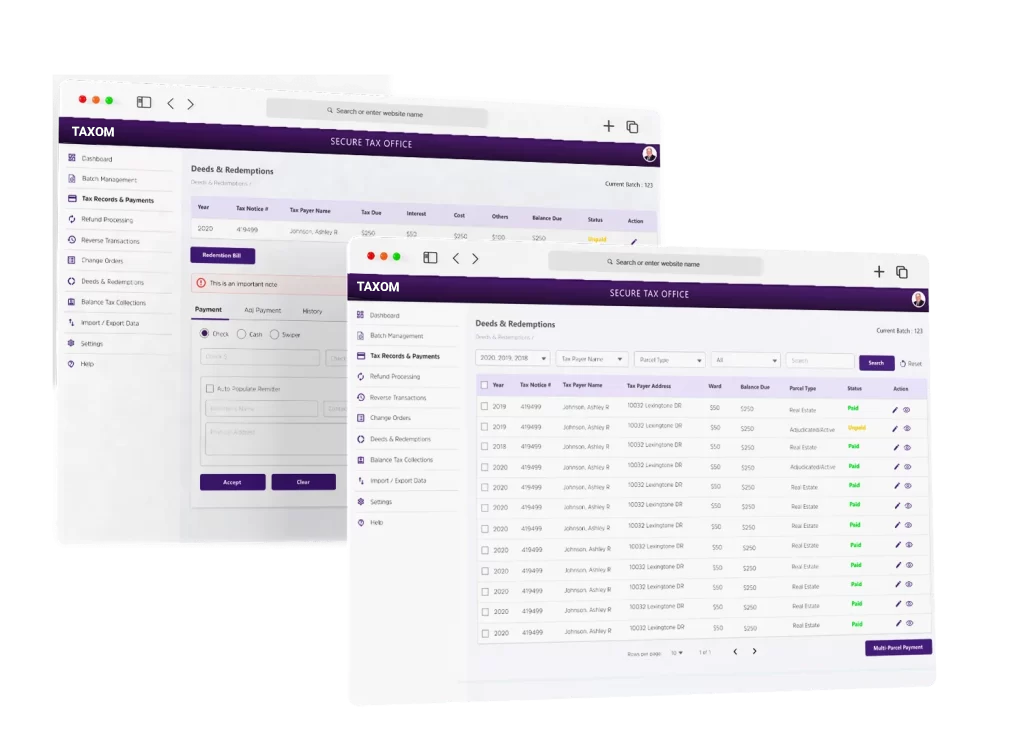

Considering both users’ needs, we developed a tax collection portal for property tax filing and management, offering a consolidated web application. The property tax office management system comprises several modules that are built to streamline tax collection and management processes. These modules include:

Streamlined processing of tax payments in batches, improving the efficiency and accuracy of the tax management office team.

Added convenient payment options for taxpayers, including cash, credit card, cheque and electronic cheque (ACH).

Enabled automated handling of refund requests, ensuring timely and accurate reimbursements.

This allows the fast reversal of incorrect transactions, reducing administrative efforts and improving accuracy.

Enabled efficient processing of redemption payments for property taxes.

Streamlined end-of-month processes, including accurate distribution of tax amounts to relevant authorities.

Comprehensive management of tax sales, ensuring compliance and transparency.

Flexibility to handle changes in property ownership and the generation of detailed reports for tracking and analysis.

Each testing phase aimed to validate functionality, stability, user experience, and application responsiveness.

Through our complete product development services, we successfully built and delivered a cutting-edge Tax Office Management system that transformed the tax collection and management processes for our client.

The automated features and streamlined processes significantly reduced manual efforts, enabling the tax collection office to handle tax payments, refunds, and fund tracking more efficiently.

The intuitive interface and convenient payment options improved the overall experience for taxpayers and administrators, making it easier to file, collect and distribute taxes.

The robust security measures implemented within the system ensured the protection and privacy of sensitive taxpayer information, addressing the client’s data security concerns.

Due to the wide success of the property tax office management system, the solution was scaled and is now under use in eight parishes.

Tax Collected

Parcels Processed

Number of Parishes

Datics AI stands out for their punctuality and seamless communication. Their exceptional customer service and work quality made the process efficient and smooth.

Datics has been an invaluable partner in custom software development, delivering high-quality solutions swiftly. Their services come highly recommended.

Partnering with Datics AI transformed our projects. Their innovative solutions consistently exceeded our expectations, always delivering a step ahead

The Tax Office Management system developed by Datics AI empowered our client, a US state’s tax collection office, with a comprehensive and efficient solution for their tax collection and management needs. We used agile methodology and a cross-functional collaboration model to deliver exceptional results.

Our approach was to thoroughly analyze the client’s requirements and pain points and then develop a detailed roadmap aligned with their needs, ensuring all essential functionalities were included. We focused on creating an intuitive and user-friendly interface for the web application. Our idea was to prioritize visual appeal and ease of use, enhancing the overall user experience for taxpayers and administrators.

Discover what is software development life cycle. Learn stages, importance, and models with our ultimate guide. Optimize your software projects now!

Discover everything about what are business intelligence tools, types, key features, benefits, and how to choose the right one for your business.

Discover what is product development software, its benefits, key features, and methodologies in our ultimate guide. Enhance your product strategy today!

Share the details of your project – like scope, timeframe, or business challenges. Our team will carefully review them and get back to you with the next steps!

© 2024 | All Right Revered.

This guide is your roadmap to success! We’ll walk you, step-by-step, through the process of transforming your vision into a project with a clear purpose, target audience, and winning features.